Mint houses keep designing gold and silver coins in the XXI century quite actively. However, there are two different ways of seeing such releases. Some buyers treat the value of coins like an investment, but others evaluate artistic expression and numismatic authority. Which approach fits you better and what is the actual difference in purchasing strategies? Here is all you need to know at the start.

Why Modern Silver Coins Split Into Two Distinct Categories

Silver demand has surged in recent years, especially due to industrial applications and global production pressures. This has pushed many buyers toward silver-based assets, including government-minted coins. As a result, the market now moves in two clear directions:

- Bullion coins for liquidity, metal content, and predictable pricing.

- Collectible silver coins for design rarity, low mintages, and premium appreciation.

Each group behaves differently in the marketplace. Bullion responds almost entirely to spot price changes, while collectibles can rise in value even during periods of flat silver prices.

Bullion Coins: Built for Metal Value and Easy Resale

Leading world mints produce high-purity bullion coins that track silver closely. Examples include:

- American Silver Eagle

- Canadian Maple Leaf

- British Britannia

- Austrian Philharmonic

These coins:

- Contain 1 oz of .999 or .9999 silver

- Trade with 5–10% premiums above melt

- Are produced in millions of pieces each year

- Offer fast resale through dealers worldwide

Bullion suits buyers who prioritize liquidity. During inflationary periods, investors stack these coins to maintain purchasing power.

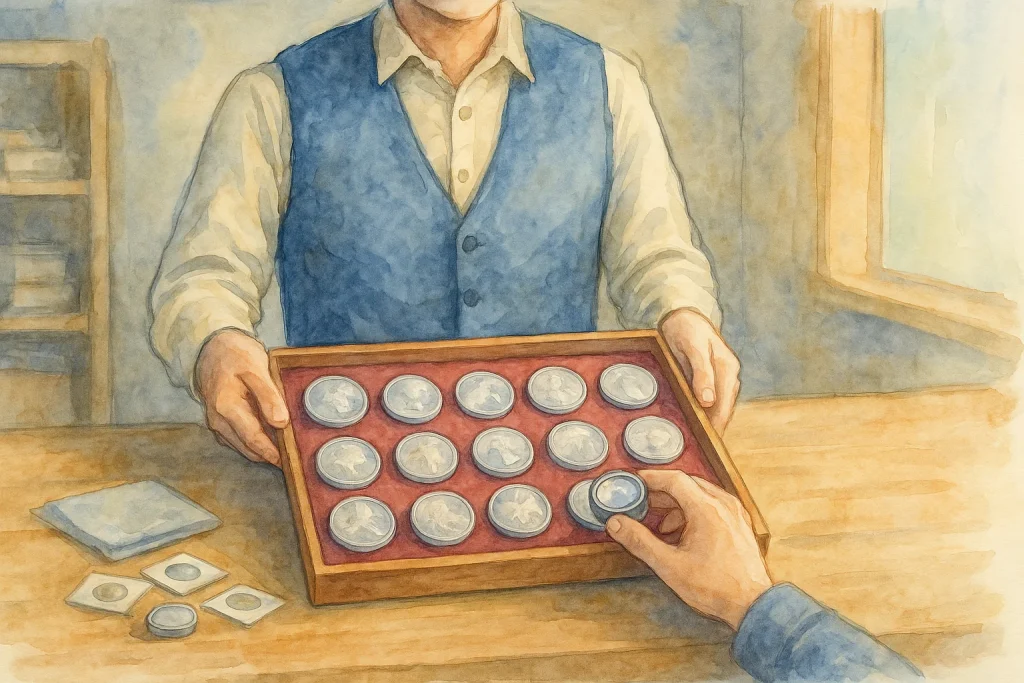

Collectible Silver Coins: Where Art, Scarcity, and Condition Drive Value

Collectible modern issues behave more like numismatic assets, especially if you check the coin appraisal app and recent market updates. Popular examples include Australian Koalas, Chinese Pandas, and Kookaburras. These coins often feature:

- Annual design changes

- Low mintages, sometimes under 50,000

- Premiums of 20–50% or more over spot

- Striking proof or high-relief finishes

Their value grows through scarcity, series continuity, and condition. A perfect MS70 coin from a desirable series often appreciates far faster than standard bullion.

How Bullion Creates Value Through Metal Content

Understanding how bullion and collectible silver coins differ in value makes it easier to choose the right mix for your goals. While both are made from high-purity silver and marked as popular in a coin values app, they interact with the market in completely different ways. Examining premiums, liquidity, mintages, and long-term behavior reveals how these two categories function.

Bullion coins hold value primarily through the current price of silver. Their key strengths include:

- Low premiums (5–15% above melt)

- High mintages that support global liquidity

- Uniform designs that simplify verification

- Fast resale, even in large quantities

Because these pieces follow metal markets so closely, they act like a physical extension of a silver investment. Design changes are rare, so appreciation usually comes from rising spot prices rather than collector-driven demand.

Bullion excels in:

- Inflation hedging

- Large-volume purchases

- Quick liquidation

- Long-term metal storage

How Collectibles Gain Value Through Scarcity and Design

Collectible silver coins rely less on metal content and more on artistic and numismatic elements. Several factors influence their long-term performance:

- Annual redesigns that add novelty

- Controlled mintages that create scarcity

- Proof and high-relief finishes that attract visual appeal

- Strong grading potential, especially at MS70 or PF70

Premiums for these coins typically start at 20–50% and can rise well beyond 100% when demand grows or supply tightens. Examples such as Chinese Pandas and Perth Mint Koalas are known for steady appreciation due to their evolving artwork and limited output.

Side-by-Side Comparison

| Aspect | Bullion Coins | Collectible Coins |

| Primary Value | Spot price | Numismatic premium + spot |

| Premium Range | 5–15% | 20–100%+ |

| Liquidity | High | Moderate |

| Mintage | Millions | Thousands |

| Best For | Stability and hedging | Appreciation potential |

This contrast shows how each category serves a different purpose. Bullion builds financial security; collectibles reward patience and strategic selection.

Planning an Investment Mix That Works Long Term

Modern silver coins work best when viewed through two lenses at once: their metal value and their collector potential. A balanced approach helps you capture stability from bullion and growth from premium series, creating a portfolio that performs across market cycles.

A practical approach many collectors use is a 70/30 split:

- 70% bullion for steady metal exposure and liquidity

- 30% collectible coins for long-term appreciation through scarcity

This ratio keeps the portfolio grounded in silver value while allowing room for designs that evolve yearly. Timing also plays a major role. Acquiring bullion during dips in spot price strengthens your cost basis. For collectibles, early release windows and low-mintage announcements often create strong entry points.

Professional grading enhances resale value in both categories, but collectibles benefit the most. High-end slabs from PCGS or NGC can turn a standard purchase into a top-tier asset, especially in series with loyal followings.

Practical Viewing Techniques for Accurate Evaluation

Seeing a coin in person reveals details that photos rarely capture. A structured inspection routine helps you judge bullion consistency and collectible quality.

Use these viewing tips:

- Check strike sharpness with a 10× loupe.

- Look for bagmarks, especially on bullion that ships in tubes.

- Examine toning for natural patterns or signs of past cleaning.

- Confirm weight and size when buying raw bullion pieces.

- Inspect edges and rims for signs of damage or weakness.

Collectible coins must remain pristine to hold premium value, while bullion tolerates minor marks as long as weight and purity are intact.

Leveraging Digital Tools for Verification and Tracking

Modern collecting benefits greatly from technology. Apps such as Coin ID Scanner allow fast confirmation of composition, edge type, year of issue, and price references through photo identification. The app’s 187,000-coin database, smart filters, and AI Coin Helper support both investment tracking and daily organization.

Digital logs make it easier to monitor trends, adjust allocations, and document condition changes over time. This habit turns casual viewing into informed decision-making.

Viewed correctly, modern silver coins offer two powerful benefits: metal security and artistic value. By blending bullion for stability and collectibles for future growth, you build a silver strategy that adapts, strengthens, and remains rewarding for years.